Hair transplants have become, for men, what breast augmentation was for women in the early 2000s: a rapidly growing industry shaped by evolving beauty standards, heightened social media visibility, and the modern preoccupation with youth and appearance. On TikTok, videos of men flying home from Turkey with freshly bandaged scalps have become a genre of their own. One viral comment wittingly suggested renaming Turkish Airlines to “Turkish Hairlines.”

No longer a silent insecurity, hair loss has become the centre of a multibillion-dollar global industry, expected to reach 17.9 billion dollars by the end of 2025. At the heart of this boom is Turkey, now firmly established as the world’s leading destination for hair transplants. Clinics in Istanbul carry out an estimated 1,500 procedures each day, transforming the city into a hub for medical tourism. With prices often under 4,500 dollars compared to 10,000 dollars or more in the US or Europe, the country has perfected the package; combining procedures with five-star hotel stays, private drivers and seamless aftercare. Turkey’s reputation was already bolstered by its thriving dental surgery sector, making it an all-in-one destination for what some are calling youth restoration travel.

A younger generation losing hair under the scrutiny of social media is fueling the rise of hair restoration

Millennials and Gen Z are going bald earlier and they’re doing it online. What was once a quiet, age-related concern has become a visible, accelerated reality for younger people navigating the pressures of always-on digital life. Dermatologists report patients as young as 18 seeking treatment, with specialists pointing to a mix of chronic stress, nutrient-poor diets, restrictive eating habits and high-intensity fitness routines as key contributors to early balding.

But the real driver behind the rise of hair restoration procedures goes deeper: we are living in a culture obsessed with youth and aesthetic optimisation. Cosmetic interventions once reserved for celebrities like fillers and weight-loss injectables, have gone mainstream, shared openly across platforms and normalised in everyday conversation. And men are no longer excluded. In this environment, a receding hairline has gone beyond cosmetic concern, it’s a visible crack in the polished veneer of self-presentation and hair restoration has joined the growing menu of medically assisted self-improvement.

How Turkey positioned itself as the epicentre of hair restoration in a largely unregulated market

Turkey has perfected the business of hair restoration. With an estimated 1,500 to 2,000 procedures performed daily, Istanbul alone has become a conveyor belt for cosmetic transformation. The allure is obvious: world-class clinics, five-star hotel packages, and price tags less than half of what patients would pay in the US or UK. But behind the polished Instagram ads and seamless booking sites lies a murkier reality. No one knows exactly how many clinics operate, or how many surgeries are performed each year. Even seasoned industry professionals describe it as a data black hole.

While the Turkish Ministry of Health sets formal standards aligned with EU regulations, medical oversight is often voluntary, and enforcement is inconsistent. Many clinics operate multiple websites under different names, and a growing number rely on technicians not licensed surgeons to carry out core parts of the procedure. In some cases, one clinic may conduct up to 50 surgeries a day.

Hair transplants, after all, are surgery. And in the wrong hands, they can be devastating. Patients are often swayed by slick marketing, low prices, and influencer testimonials. But the lack of transparency makes it difficult to distinguish between legitimate medical care and pure commercial enterprise. Industry insiders warn of a coming wave of “repair patients”—men who opted for low-cost, high-volume clinics in their twenties and may find themselves with unnatural or unsustainable hairlines by the time they’re forty.

In Turkey, the technician model has been key to scaling the industry, but it’s also the most controversial. While some argue that experienced technicians can deliver excellent results, others point out that cutting into the scalp, by any definition is surgery and should be treated as such. As the sector continues to grow, even leading doctors in Istanbul agree that regulation is long overdue.

Big Pharma is also cashing in, with telehealth startups turning treatments into lifestyle packages

While transplants may grab the headlines, the pharmaceutical industry is quietly powering a parallel boom in non-surgical hair loss treatments. Finasteride, a drug originally developed for prostate conditions, has been repackaged by brands like Hims and Keeps as a lifestyle solution shipped monthly, marketed like skincare, and discreetly managed through online consultations. But it’s not without controversy. Known side effects include loss of libido, mood changes, and, in rare cases, post-finasteride syndrome. Still, demand continues to rise.

Now another older drug is having a revival. Minoxidil, the active ingredient in Rogaine, first gained popularity in the 1990s as a topical foam. Today, dermatologists are prescribing it in low-dose pill form, an off-label use that’s gaining traction thanks to studies showing improved efficacy when taken orally. The pill version is cheaper, easier to stick with, and often preferred by patients tired of messy applications. Despite the lack of formal FDA approval for hair loss, its affordability, (some pharmacies offer a month’s supply for under five dollars) makes it a quiet disruptor.

Telehealth firms are accelerating this shift, offering quick prescriptions and home delivery with minimal friction. Platforms like Ro and Hims have transformed hair loss treatment into a subscription model, bypassing long wait times and specialist referrals. For some, it’s convenience. For others, it’s accessibility. And for investors? It’s recurring revenue in a market obsessed with aesthetics.

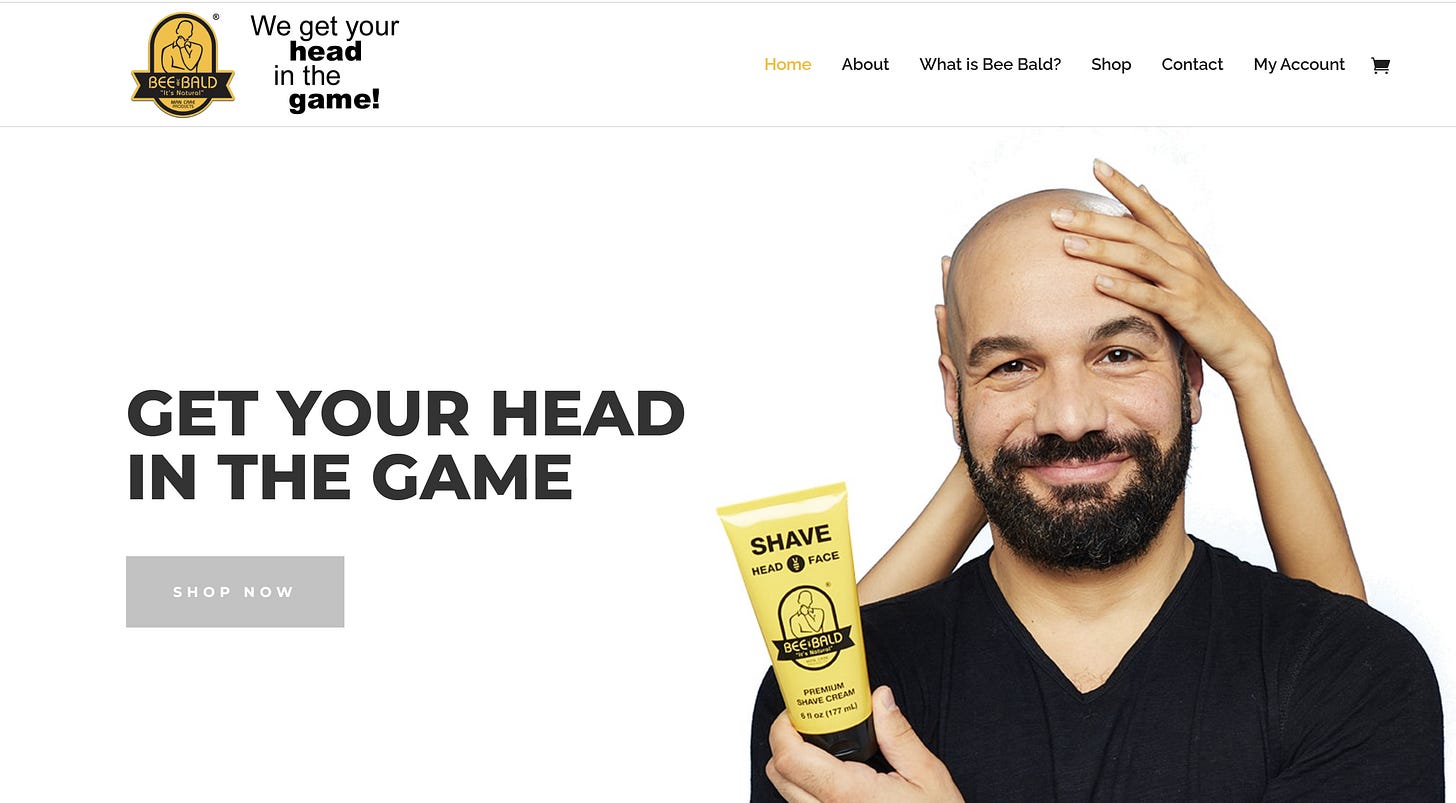

A countertrend is rising with more men embracing their bald heads, and skincare and wellness brands are missing the moment

Amid the surge in hair restoration, a quiet shift is gaining momentum. More men, even younger men, are choosing to embrace baldness early, shaving their heads, reframing the look, and rejecting the idea that hair is the only marker of youth or attractiveness. But while cultural attitudes are shifting, the market has yet to follow. Mainstream beauty brands still lag behind in catering specifically to bald or balding consumers. Labels like Nivea and Harry’s continue to rely on generic products and tongue-in-cheek marketing, offering little in the way of dedicated care or community. The opportunity is wide open: to build a bald-positive brand that offers tailored grooming, skincare, and a new kind of identity play, one rooted in acceptance, not anxiety.

Hair restoration, once niche, is now undeniably mainstream. But the conversation is no longer binary. As the industry expands, there’s room for innovation on both sides: for those who want to reclaim their hair, and for those choosing to embrace its absence. Brands that recognise this duality, and speak to it with clarity and credibility, will be the ones that win.