Great, e.l.f. has acquired Rhode…but for the brand’s longevity, discretion is key

In a beauty industry twist that feels both inevitable and risky, e.l.f. Beauty has officially acquired Rhode Skin, Hailey Bieber’s minimalist skincare brand, for a headline-grabbing $1.0 billion. It is a high-stakes move that places a three-year-old startup alongside legacy players, but also tests whether premium appeal can survive inside a mass-market portfolio.

Rhode’s glazed donut rise

Launched: June 2022

FY2024 Net Sales: $212 million

Product range: Just 10 SKUs

Distribution: Direct-to-consumer only

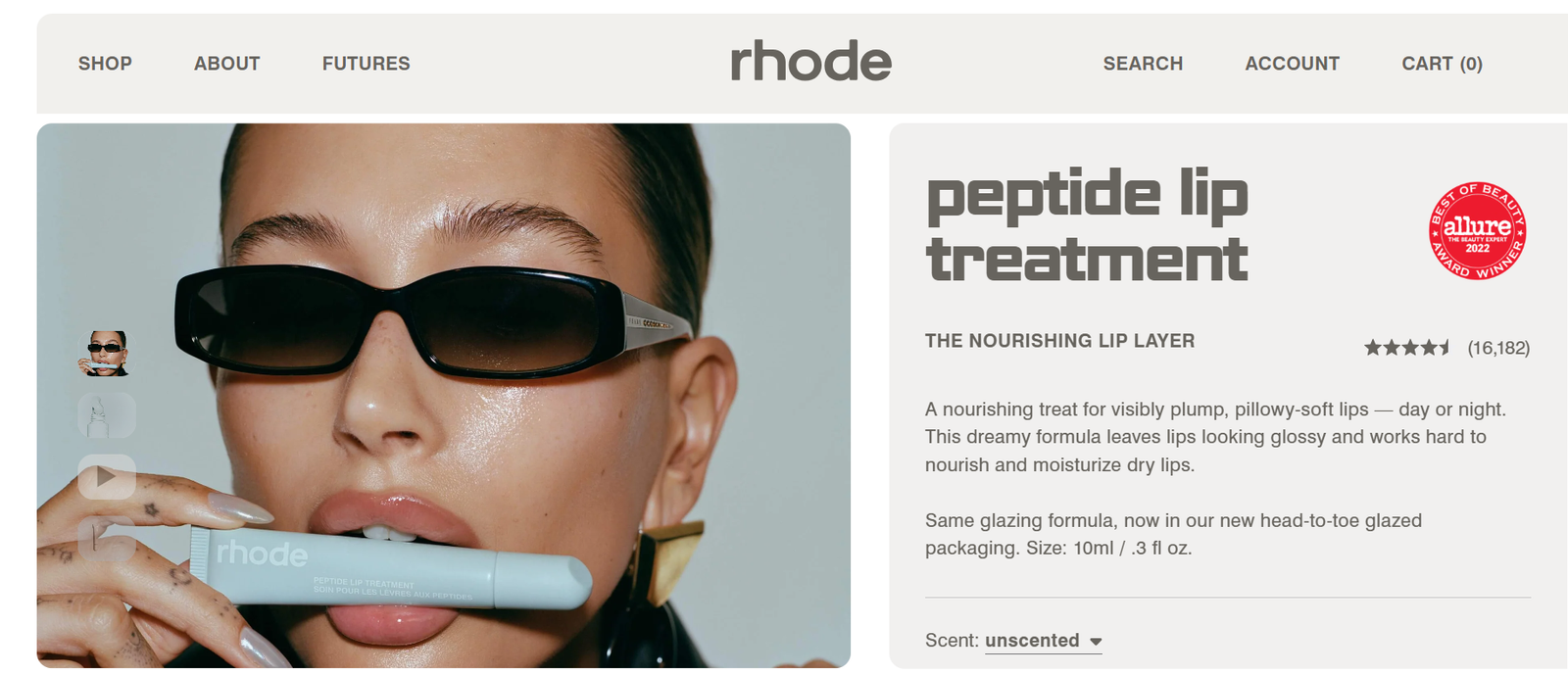

Hero product: Peptide Lip Treatment, central to the “glazed donut” skin trend

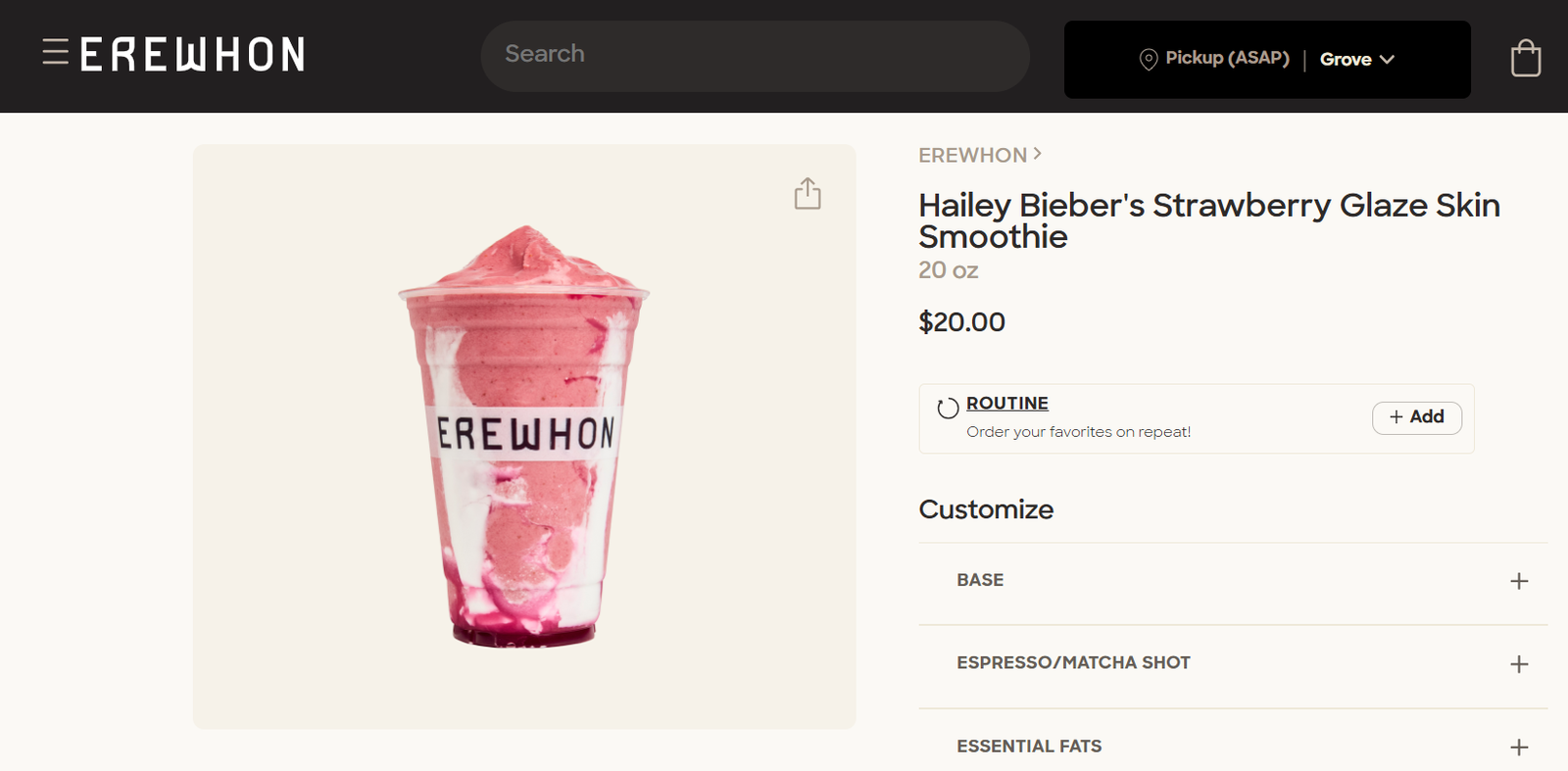

Rhode didn’t scale through saturation. It scaled by becoming the brand for the TikTok generation. It spoke in Hailey’s voice, leaned into a minimalist edit of high-functioning products, and became shorthand for a clean-girl aesthetic. No clutter. No chaos. No confusion. The vibe of the product is “You moisturise with Rhode, then sip your $20 Erewhon smoothie.

Why e.l.f. bought it.

For e.l.f., this acquisition is a strategic win.

It enters the prestige skincare space without having to build from scratch

It gains a direct-to-consumer brand with a cult following

It expands its retail footprint, with Rhode set to launch in Sephora across North America and the UK

It buys into community, not just product

The deal is structured with $600 million in cash, $200 million in e.l.f. stock, and an additional $200 million tied to Rhode’s future performance over the next three years.

The brand risk ahead.

Rhode is not e.l.f.. As a reddit user aptly described, the deal is one between “unlikely bedmates”.

Rhode sells restraint. e.l.f. sells access.

Rhode lives on a marble counter in a Tribeca bathroom. e.l.f. lives on an endcap at Target.

Both can win. But not if they blur.

How to protect the brand.

For this acquisition to have long-term value, the following must hold:

Keep the relationship discreet. Rhode must retain its autonomy and voice. No co-branded marketing. No shared taglines.

Preserve premium positioning. Price points, pack formats, and limited drops need to remain exclusive and aspirational.

Guard the aesthetic. Rhode’s branding is its moat. That means no neon fonts, QR code stickers or “#elfingamazing” hashtags.

Resist over distribution. Rhode’s scarcity strategy has worked. A rollout that is too broad, too fast, would flatten the brand.