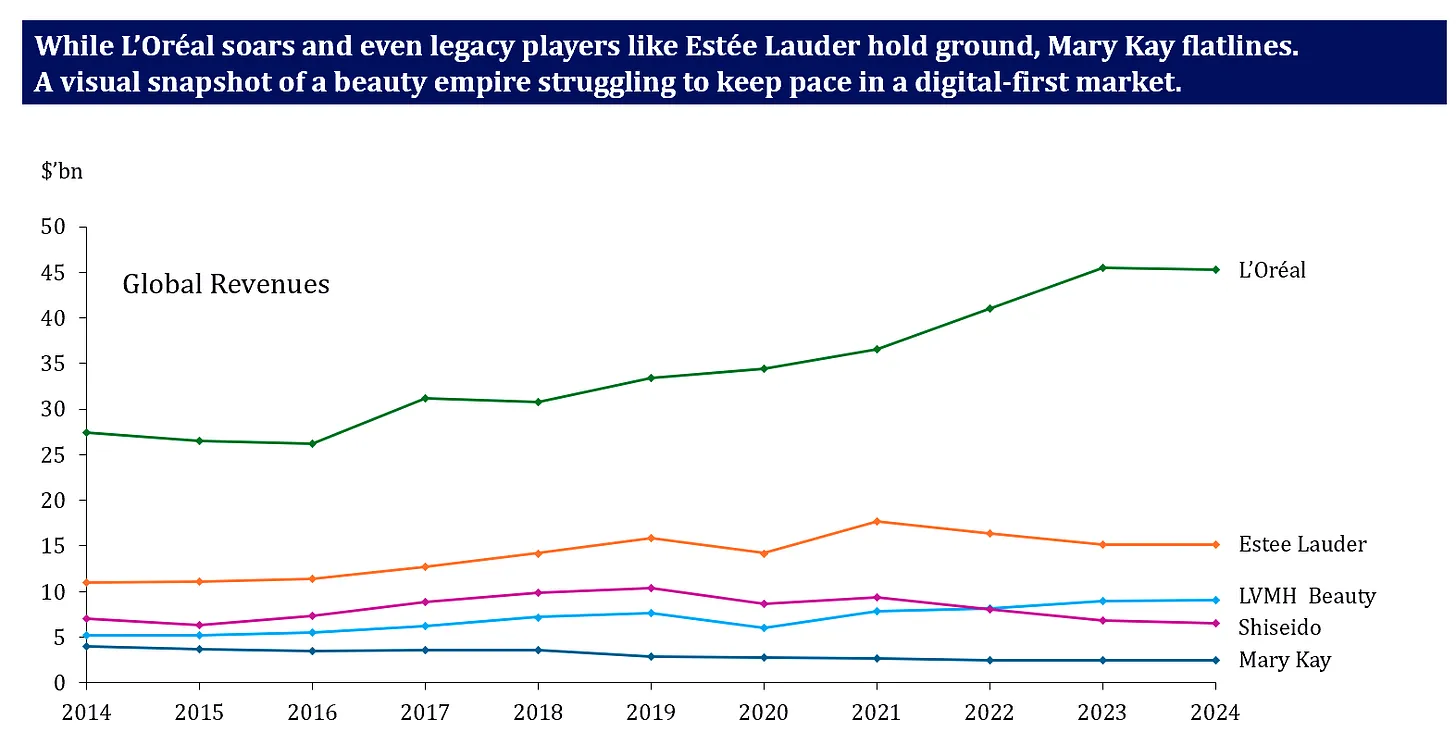

For the average millennial and Gen X, the name Mary Kay conjures immediate recognition. At some point in time, the brand name was a household word for cosmetics, much the same way “Kleenex” is often used in lieu of “facial tissue.” Once synonymous with pink Cadillacs, direct selling, and the aspirational glow of American beauty, the Mary Kay brand today is more often cited in MLM controversies than on bestseller skincare lists. While its foundational model of empowering women through entrepreneurship was revolutionary in the mid-20th century, Mary Kay has struggled to hold its footing in a hyper-saturated, digital-first beauty landscape. The existential question facing the company is clear: can its multi-level marketing (MLM) structure carry it forward in this generation, or will it be forced to pivot into a direct-to-consumer (DTC) model? And if so, is the brand name alone enough to sustain such a drastic transition? The outlook, increasingly, appears negative.

This case study examines the structural and cultural shifts that have contributed to Mary Kay’s decline. We also explore how the company is attempting to remain relevant in a space that increasingly favours transparency, authenticity, and influencer-driven engagement.

II. Mary Kay’s Rise in Postwar America

Founded in 1963 by Mary Kay Ash, the brand was built on a vision: to give women the tools to achieve financial independence while selling beauty. It was a pitch tailored to the postwar American housewife, and it worked. Mary Kay offered a clear pathway to empowerment: equal parts lipstick and liberation. The pink Cadillac, launched in 1969 as a reward for top sellers, became a pop culture symbol of female success.

The brand leaned into community and competition, offering recognition, incentives, and rituals that created a sense of belonging. It also maintained strict control over its image. Mary Kay was as much a lifestyle as it was a product line, anchored in wholesome femininity and polished optimism. By 1995, Mary Kay had generated $950 million in wholesale sales—including $25 million in Russia alone, and by the early 2000s, it had reached over $2 billion in annual sales. In 2001, the year of Mary Kay Ash’s death, the company had over 800,000 representatives and $1.2 billion in annual sales, expanding to more than 35 global markets.

III. The Cracks Beneath the Gloss: Shifting Consumer Values and MLM’s Predicament

As beauty consumers shifted toward clean formulas, personalized regimens, and influencer-backed authenticity, Mary Kay remained wedded to a model that prioritized recruitment over innovation. Crucially, the brand’s product innovation and formulations have largely stagnated, with quality often perceived as comparable to basic store-level products rather than the cutting-edge, ingredient-focused offerings demanded by today’s discerning consumers.

Multi-level marketing (MLM), once seen as a clever distribution strategy, is now often criticized for its predatory structure. Younger consumers, skeptical of commission-driven sales and wary of blurred lines between friendship and business, have grown increasingly disillusioned. The core issue lies in an unequal internal structure: as of 2022, more than 85% of active independent beauty consultants earned no commissions. Among those who did, the average annual earnings were just $208. Only a small subset of higher-level consultants—Sales Directors and above—saw substantial returns, with incomes ranging from $20,907 to $148,598. This stark reality, often hidden behind aspirational marketing, fuels widespread criticism.

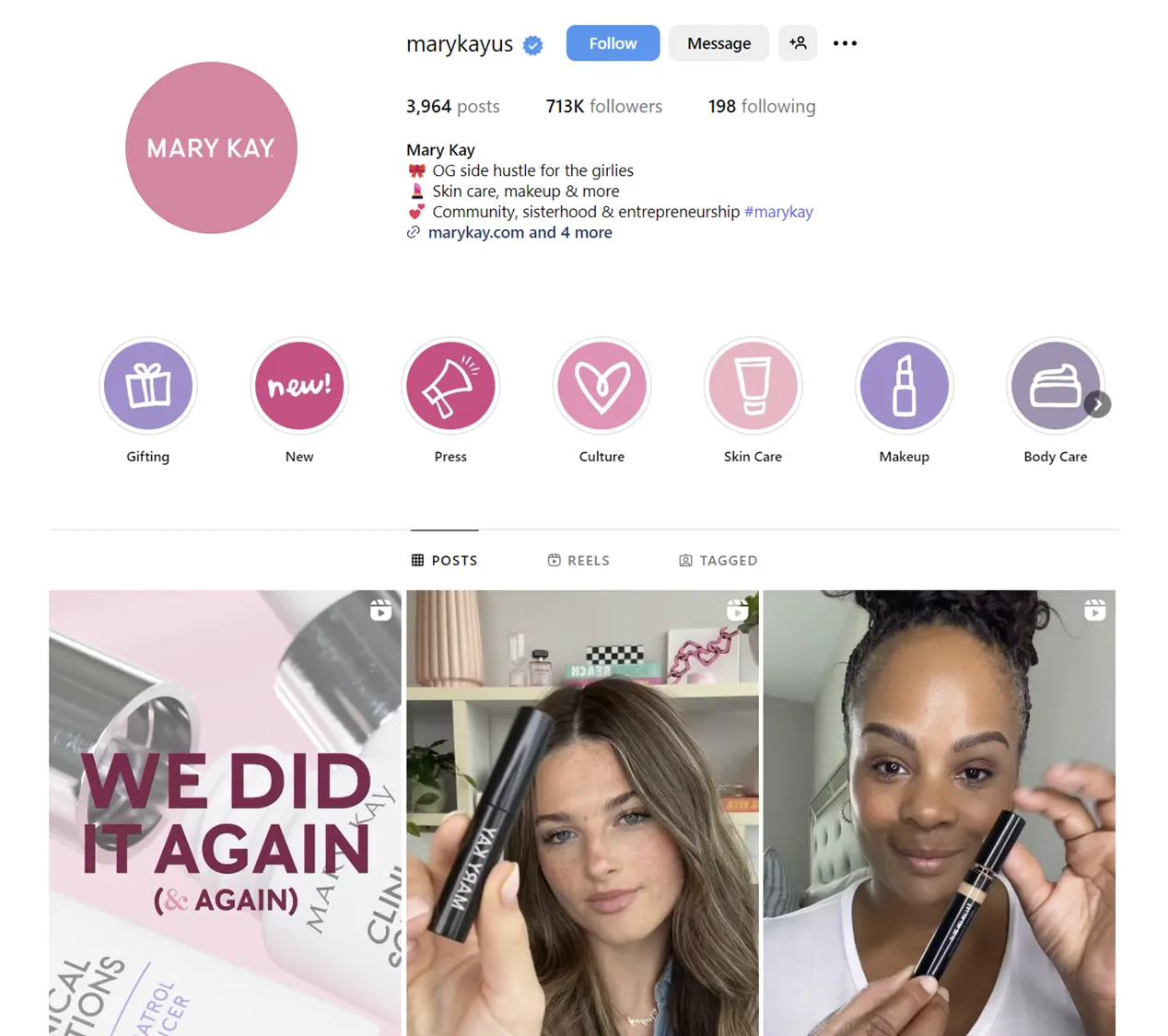

Simultaneously, the brand has struggled to break through online. In an industry where TikTok trends can make or break product lines overnight, Mary Kay’s digital presence remains limited and inconsistent. Their official Instagram page (@marykayus), for example, with 713K followers and 3,963 posts, still prominently features “OG side hustle for the girlies” in its bio, signaling a continued focus on recruitment and the business opportunity rather than product efficacy or innovative formulations. This contrasts sharply with modern beauty brands that prioritize product showcases, ingredient transparency, and user-generated content. The consultant-based model doesn’t lend itself easily to viral moments, nor does it cater to the frictionless convenience of modern e-commerce. While competitors like Glossier and Rare Beauty leverage sleek branding, data-driven targeting, and community storytelling, Mary Kay still relies on person-to-person pitches that feel dated in the age of digital intimacy.

IV. When Nostalgia is Not Enough: A Product and Perception Problem

Mary Kay has made attempts to update its image, including newer packaging, social media campaigns, and skincare innovations. But these efforts often feel like surface-level refreshes rather than a true strategic overhaul, as the company continues to promote the same top-down incentive structure and heavily curated narratives of success.

There’s also the matter of brand perception. For many millennials and Gen Z consumers, Mary Kay exists in the same mental category as Tupperware parties and Avon brochures: relics of another era. This sentiment is evident in public forums, such as a recent Reddit thread on r/MakeupAddiction titled “Mary Kay – does anyone use this stuff anymore?” The top comments reflect a desire to avoid recruitment, a preference for purchasing via Amazon rather than reps, and a general disinterest in the brand’s traditional distribution model, with one user stating, “The last thing I want to do is be recruited when all I want to do is get a sample of a few things.” While nostalgia can be a powerful lever in fashion and lifestyle, beauty operates differently. Credibility is tied to efficacy, identity, and cultural currency, not just legacy.

The struggles of other direct selling brands further underscore the precariousness of this model. For instance, Beautycounter, which also operated on an MLM structure, offers a potent cautionary tale. Despite its modern branding and focus on ingredient transparency, it faced insurmountable challenges within that very framework. Its recent near-collapse and restructuring – including a private equity acquisition that soured, significant consultant alienation due to compensation changes, and ultimately a “foreclosure” sale that saw its founder repurchasing the brand from bankruptcy, leading to a pause in all operations in April 2024 – highlight that the fundamental issues of the MLM model are systemic.

V. So, Can Mary Kay Matter Again? We think so, and here’s our take

Relevance is not impossible, but it demands radical clarity and a willingness to dismantle foundational elements of its business. Mary Kay must confront the severe limitations of its MLM structure and invest heavily in a hybrid distribution that allows for both consultant-led engagement and robust direct-to-consumer (DTC) options. The fundamental question remains: can Mary Kay survive without its structural MLM format? Can they successfully pivot into DTC, and is the brand name itself strong enough to sustain such a transition given the current negative perceptions and product quality concerns?

If Mary Kay were to truly take the reins and turn around the brand, it would require a dual approach: a radical rethink of its core business model and a sophisticated celebration of its enduring legacy with modern storytelling.

To Rethink the Business Model and move from Direct Selling to Community Commerce:

1. The company would need to rebrand consultants as “Beauty Brokers,” empowering them as micro-influencers with digital toolkits, affiliate codes, and customizable pop-up shops. This could extend to creating “The Mary Kay Market,” a digital platform akin to Etsy meets Glossier, where sellers co-create SKUs, access trending ingredients, and earn royalties.

2. Product strategy would demand a skincare-first, ingredients-first approach, launching a Gen Z pink sub-brand (e.g., “Kaylab”) with Y2K-cool, refillable packaging and clinical-meets-cute formulations, alongside curated starter sets like “Dorm Room Dew.” A “Total Texture Takeover” with multi-sensorial formulations and tactile packaging could appeal to ASMR and texture-core trends.

3. Visually, Mary Kay would need to go high-aesthetic, collaborating with rising art directors for a beauty zine feel, and adopting retro-futurist packaging. To hijack culture, campaigns like a “Pink Cadillac Project” for digital entrepreneurs and “My First Pitch” TikTok series could make the brand meme-able again.

4. Distribution would shift to pop-ups, not just parties, with immersive “Mary Kay Mirror” events and AR-powered digital mirror apps. The narrative would pivot from ‘Selling’ to ‘Building’ with a slogan like “Built Beautifully,” fostering an internal culture of “From Consultant to Creator.” Strategic “Collab Roulette” with fashion brands, tech companies, or cult perfumers could inject fresh energy.

Alternatively…

Mary Kay could leverage its deep heritage with a “Legacy Lives Loudly” campaign, celebrating its iconic status while infusing it with modern relevance. The concept, “Think We’re Your Grandmother’s Lipstick? Think Again,” would drive home a powerful message of continuity and evolution. This could involve a “Lineage of Boldness” series of mini-films tracing iconic products (pink blush, red lipstick) through generations, ending with “Same pigment. New power.” An “Originals” campaign would spotlight long-term customers and consultants, pairing them with Gen Z influencers to recreate signature looks, affirming that “The original influencers didn’t need filters.” Limited-edition time capsules with retro packaging and QR codes leading to historical films, or a “Passed Down, Powered Up” print campaign, could physically and visually bridge eras. Merging tradition with tech, a “Legacy Vault AR Experience” could let users scan vintage products to unlock historical filters and tutorials, while “The Mary Kay Memoirs” could offer audio storytelling of women’s experiences with the brand. Hero slogans like “Because real beauty legacies don’t fade” or “We’re not stuck in the past, we built it” would encapsulate this renewed identity.

Last Words

Mary Kay’s DNA still contains power: a vision of beauty as a tool for self-determination. But to channel that effectively today, the brand must move beyond nostalgia and confront the demands of a new consumer reality. The outlook is fairly negative. Legacy alone won’t cut it in a beauty market defined by speed, authenticity, and cultural relevance. The pink Cadillac may still run. But to make it matter, Mary Kay needs more than a fresh coat of paint. It needs a new engine, and potentially, a completely new chassis.