The luxury market is slowing down. That’s not news.

According to Bain & Company, global sales of personal luxury goods are expected to contract between 2% and 5% in 2025. In Q1 alone, LVMH’s Fashion & Leather Goods division saw a 5% drop in organic revenue, its second consecutive quarterly decline. Kering fared worse, down 14% overall, with Gucci revenue falling 25% organically. Even Saint Laurent and Balenciaga weren’t spared.

We can know the luxury sector is cyclical. This moment will pass. But even in moments of contraction, some categories and products, particularly within leather goods and footwear continue to sell.

That’s because when the sentiment shifts, consumers recalibrate their definition of value. And right now, utility is doing what logos can’t.

In a fatigued market, function comes first.

The era of impractical luxury is waning. The idea that a handbag could be stiff, heavy, or unusable but still sell out based on monogram alone is losing steam. Aspirational consumers, in particular, are rethinking what justifies the price tag. A beautiful clutch that fits nothing is now seen as unserious. A £2,000 handbag with no zip, no compartments, and no durability? Less appealing.

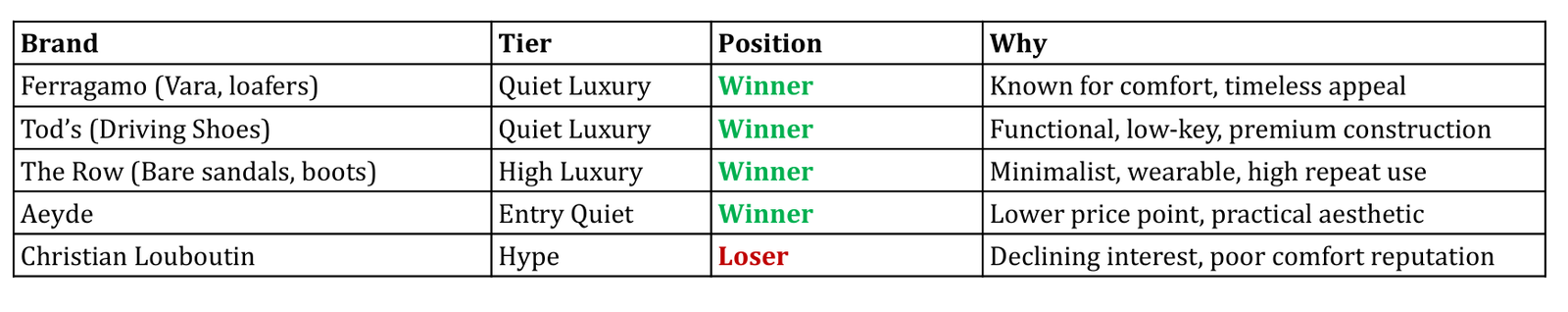

The same scrutiny is hitting footwear. Take the $1,500 Saint Laurent Opyum sandals: once a staple on every It Girl’s feed thanks to their skinny strap and sculptural YSL heel. Today, they’re as known for their impracticality as their design, with demand falling across both retail and resale platforms. Louboutin’s red soles are facing a similar fate, as consumers increasingly trade stilettos for walkable Tod’s loafers.

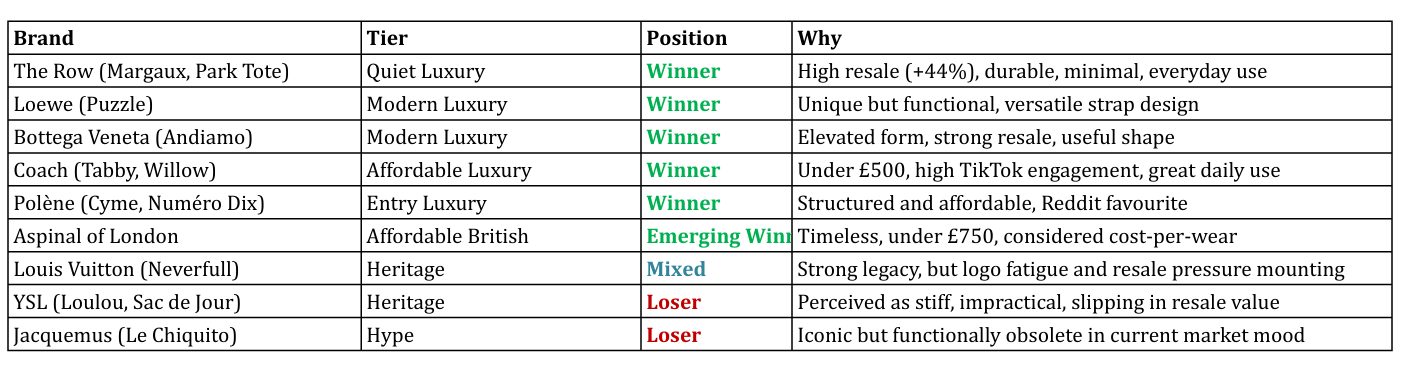

We did a sentiment analysis on designer handbags: here’s what it told us:

We analysed dozens of Reddit threads, resale platform data, and trending TikTok hashtags related to “investment handbags,” “work bags,” “comfortable shoes,” and “everyday luxury.” We found consistent signals in both qualitative sentiment and quantitative performance:

-

Users prioritise comfort, durability, and low-maintenance materials.

-

On resale platforms, totes, crossbodies, and versatile silhouettes consistently hold value better than novelty clutches or hype mini-bags.

-

Brands that design for utility, not just branding are outperforming their peers.

A few quotes stood out to us that perfectly sum the sentiments:

-

“I used to save for Louboutins. Now I save for loafers I can actually walk in.”

-

“If I can’t run errands, chase a toddler, or travel with it—it’s not worth the money.”

-

“I baby my Birkins. But my Prada Re-Nylon? I throw it everywhere. That’s real luxury to me.”

-

“Ferragamo is what I wear when I want to look like I have my life together and feel my toes at the end of the day.”

-

“I had a YSL bag I loved until I realized I never reached for it because it was too stiff. Sold it and bought a Loewe Puzzle. No regrets.”

The data: who’s winning in the era of functional Luxury

Handbags: Winners and Losers

Shoes: Comfort-Driven Standouts

The runway is catching up to real life.

On the Spring/Summer 2025 runways, publications like Vogue noted that “capacious totes” and “doctor bags” dominated, signaling a clear move away from the impractical micro-bags of seasons past. Trend reports from InStyle to WhoWhatWear have echoed this, highlighting the resurgence of top-handle and “east-west” totes as the new everyday luxury essentials.

The shift isn’t limited to womenswear. In menswear, giant totes and weekenders are replacing smaller crossbody accessories, confirming a broad-based demand for functional design. Whether it’s for work, errands, or travel, the market is rewarding bags that do more than decorate.

Because now, if it’s not wearable, it’s not aspirational. And if it can’t keep up, it can’t compete.

Why it matters

Consumers haven’t stopped spending. They’ve just redefined what makes a purchase worth it. Aspirational shoppers now weigh practicality alongside prestige. They may have less to spend, but they want what they do buy to last, work, and feel justified. That shift doesn’t just affect which products perform; it affects entire brand portfolios.

A $700 tote that carries you from Monday to Sunday is more desirable than a $3,000 logo bag that can’t carry more than your phone and lip-gloss. Even resale behaviours reflect this shift: the bags that perform well in the real world also perform well on secondhand platforms.

Hermès may sit above the market, but its success still rests on that same principle: durable, highly functional bags that quietly signal status. The resale value is astronomical, but (in most cases) the functionality comes first.

Last words: How brands should rethink their portfolio

-

Hero products should be rooted in function. What’s your Margaux? What’s your Andiamo?

-

Utility ≠ boring. Design should still lead, but construction, closure, weight, and materials must match.

-

Think beyond logos. Redundant branding is no longer carrying conversion.

-

Elevate mid-tier heroes. Brands like Coach, Polène, and Aeyde are winning not because they’re more affordable; but because they deliver value.

-

Resale matters. Design with second-life value in mind.

Luxury isn’t over. But it is under review. And for aspirational customers, if it can’t carry your day, it won’t carry your wallet.